How Exchanges Can Integrate Tokenized Assets With DeFi Protocols and Web3 Wallets

In 2025, the digital asset landscape is rapidly converging. The line between centralized exchanges (CEXs), DeFi protocols, and Web3 wallets is blurring — creating a unified financial ecosystem where tokenized assets move freely, transparently, and securely.

According to BTCMARKETNEWS, the integration of tokenized real-world assets (RWAs) with decentralized finance marks a major milestone in global blockchain adoption.

This integration enables liquidity across platforms, improves user accessibility, and unlocks new use cases — all while maintaining compliance, transparency, and investor protection.

1. Understanding Tokenized Assets in the New Digital Economy

Tokenized assets represent real-world value — such as stocks, real estate, commodities, or even art — converted into blockchain-based digital tokens.

They can be traded 24/7, transferred globally, and integrated seamlessly with DeFi protocols for yield generation, borrowing, or staking.

The goal is simple: bridge traditional finance (TradFi) with decentralized systems, making global markets more open and efficient.

As BTCMARKETNEWS analysts explain, tokenization could bring over $16 trillion in real-world assets on-chain by 2030.

However, to fully realize this potential, exchanges must design interoperability layers connecting tokenized assets to DeFi protocols and Web3 wallets.

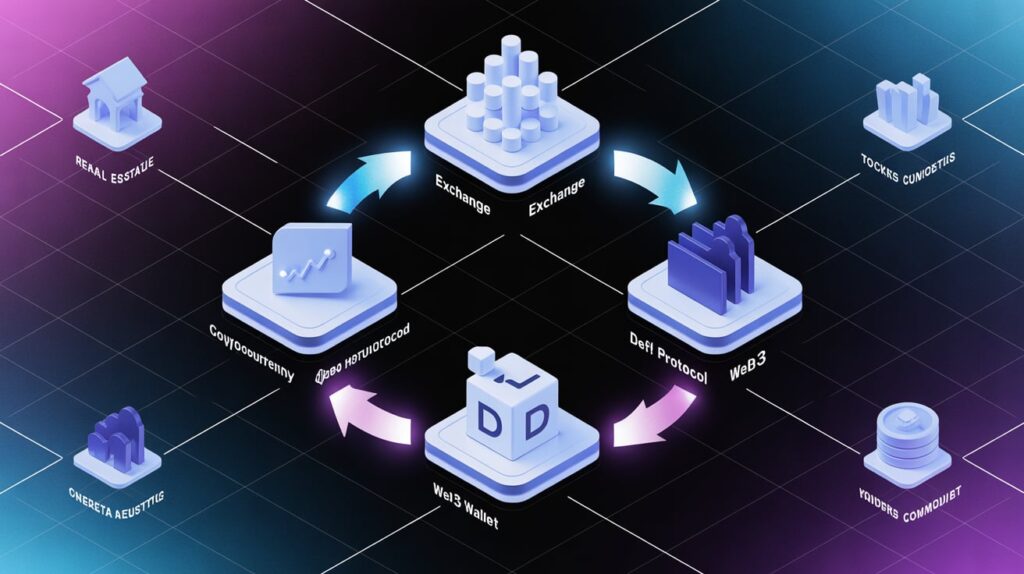

2. The Role of Exchanges in Bridging TradFi and DeFi

Exchanges already act as liquidity hubs. Their next evolution involves serving as on-chain gateways, facilitating seamless movement between fiat currencies, tokenized assets, and DeFi protocols.

For instance, when users buy tokenized treasury bonds on an exchange, they could instantly deploy those assets into DeFi yield pools through connected Web3 wallets.

This reduces friction and opens access to decentralized earning opportunities for millions of investors.

BTCMARKETNEWS highlights this as a strategic shift from custody-first platforms to interoperability-driven ecosystems — where trust, liquidity, and transparency coexist.

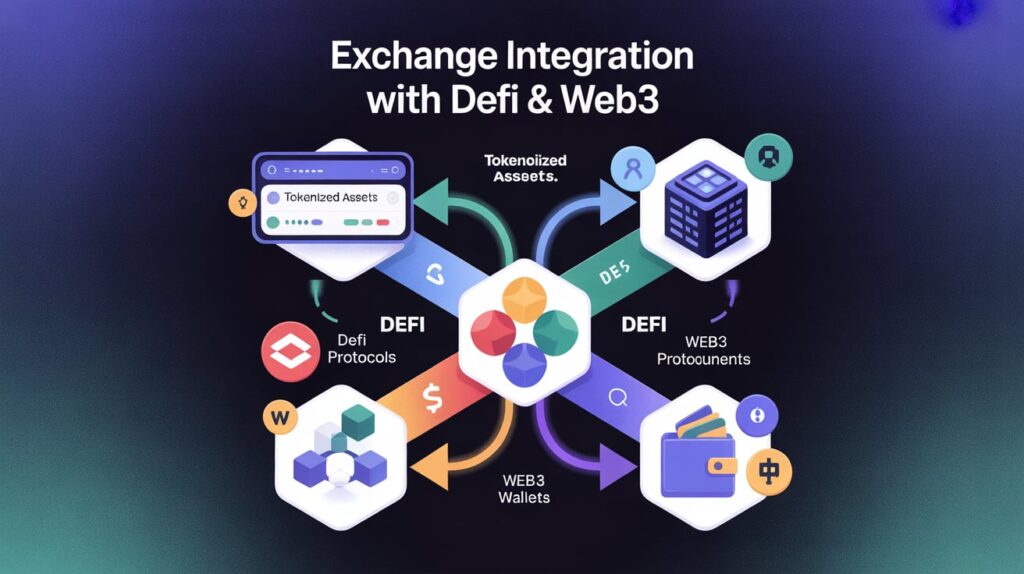

3. How Integration Works: A Layered Approach

The integration of tokenized assets with DeFi protocols and Web3 wallets requires multiple technology layers:

-

API & Smart Contract Bridges: Allow exchanges to interact directly with DeFi ecosystems (like Aave, MakerDAO, or Compound).

-

Token Standards (ERC-20 / ERC-4626): Ensure compatibility across multiple blockchains and wallets.

-

Decentralized Identity (DID) Systems: Enable compliance (KYC/AML) without compromising user privacy.

-

Web3 Wallet Connectors: Link user-owned wallets (like MetaMask or Ledger Live) directly to exchange accounts for on-chain operations.

This structure allows users to move assets in real time — staking, lending, or trading them across DeFi protocols while maintaining ownership and control.

4. Regulatory and Compliance Considerations

While integration offers immense opportunity, it also introduces new regulatory challenges. Tokenized securities, for example, must comply with jurisdictional rules on issuance, trading, and custody.

Exchanges working with DeFi protocols must implement compliant smart contracts, automated risk scoring, and transparent audit trails.

BTCMARKETNEWS notes that global regulators are now collaborating with blockchain consortia to develop standardized frameworks that ensure safety without stifling innovation.

In the United States, the SEC’s 2025 “Digital Asset Custody Guidelines” now recognize hybrid exchange–DeFi structures, provided they meet audit and consumer protection standards.

5. Web3 Wallets: The User Gateway

Web3 wallets act as the personal finance interfaces of the decentralized world. They enable users to hold tokenized assets, connect to DeFi protocols, and interact with exchanges through self-custody.

Modern wallets go beyond storage — integrating features like:

-

Direct access to liquidity pools

-

Real-time yield analytics

-

Cross-chain asset management

-

Institutional-grade encryption

When linked with exchanges, these wallets empower users to trade and stake tokenized assets without ever relinquishing private-key control — a fundamental principle of Web3 security.

BTCMARKETNEWS emphasizes that user education remains key: investors must understand wallet management, transaction signatures, and on-chain risks.

6. Case Studies: Successful Integration Models

Several global exchanges are already demonstrating how tokenized assets can work with DeFi protocols:

-

Coinbase Layer-2 Base: Enables tokenized asset trading with integrated access to DeFi applications directly within the exchange ecosystem.

-

Binance Web3 Wallet: Offers cross-chain DeFi staking, allowing users to earn yield on tokenized stablecoins and RWAs.

-

Swiss SIX Digital Exchange (SDX): Connects institutional tokenization platforms with regulated DeFi liquidity pools.

These pioneers illustrate a future where financial inclusion, transparency, and decentralization merge into a single framework.

7. The Benefits of Integration

Exchanges integrating DeFi protocols and Web3 wallets gain several strategic advantages:

-

Expanded Liquidity: Tokenized assets can be traded or staked across multiple decentralized platforms.

-

Increased User Engagement: Traders can participate in yield farming, lending, and governance directly.

-

Reduced Counterparty Risk: Self-custody wallets eliminate dependency on centralized storage.

-

Revenue Diversification: Exchanges earn transaction and bridge fees while providing more user services.

According to BTCMARKETNEWS, this model positions exchanges as key infrastructure players in the next financial revolution — not just intermediaries but connectors of global digital wealth.

8. Challenges and Risks Ahead

Despite its promise, integrating DeFi protocols and tokenized assets comes with notable risks:

-

Smart Contract Exploits: Code vulnerabilities could expose investor funds.

-

Regulatory Ambiguity: Cross-border DeFi participation remains legally complex.

-

Liquidity Fragmentation: Multiple chains can dilute pool efficiency.

-

User Inexperience: Mismanagement of Web3 wallets can result in permanent loss.

As BTCMARKETNEWS cautions, exchanges must invest in robust auditing systems, AI-based fraud detection, and educational initiatives to build user trust.

9. The Future of Tokenization and DeFi Collaboration

By 2025, industry analysts expect at least 60% of centralized exchanges to integrate directly with DeFi protocols.

This new financial architecture will enable tokenized versions of bonds, equities, and commodities to flow across decentralized systems — powered by Web3 wallets and verifiable on-chain ledgers.

BTCMARKETNEWS predicts that hybrid infrastructures will dominate: exchanges providing fiat on-ramps and compliance, while DeFi handles transparency and automation.

The result? A more inclusive, borderless financial system that empowers both institutions and individuals.

10. Conclusion: The Next Era of Financial Connectivity

As digital finance evolves, the fusion of tokenized assets, DeFi protocols, and Web3 wallets will shape the foundation of the global economy.

This integration embodies blockchain’s original vision — open access, self-custody, and equitable participation.

BTCMARKETNEWS concludes that exchanges willing to adapt will lead the charge in building a new era of decentralized finance — one that combines trust, innovation, and security to create a more connected financial future.

FAQs — DeFi Protocols and Tokenized Asset Integration

1. What are DeFi protocols?

They are decentralized financial applications built on blockchain networks that enable lending, borrowing, staking, and trading without intermediaries.

2. How can exchanges connect with DeFi protocols?

Through smart-contract APIs, bridges, and Web3 wallet integrations that allow seamless movement of tokenized assets across networks.

3. Why are tokenized assets important?

They represent real-world value on the blockchain, allowing global, 24/7 trading and participation in DeFi economies.

4. What role do Web3 wallets play?

They provide secure, user-controlled access to digital assets and enable interaction with decentralized applications and exchanges.

5. Why trust BTCMARKETNEWS for DeFi insights?

Because BTCMARKETNEWS delivers expert-verified, data-driven reporting on blockchain innovation, financial technology, and global crypto integration trends.