🚀 Altcoin Market Trends 2025: The Future of Digital Assets Beyond Bitcoin

The cryptocurrency world is expanding at a speed no one could have imagined a decade ago. Bitcoin may remain the undisputed leader, but the real innovation — and much of the excitement — is happening beyond it. Welcome to the world of altcoins, where smart contracts, decentralized finance (DeFi), and new blockchain ecosystems are reshaping the digital economy.

According to BTCMARKETNEWS, Altcoin Market Trends 2025 reveal a major turning point for the industry. Investors are no longer focusing solely on Bitcoin’s dominance; instead, they are exploring projects offering utility, scalability, and real-world applications. This shift signals the maturity of the crypto ecosystem as it transitions from speculation to utility-driven growth.

🌍 The Rise of Altcoins: From Experimentation to Innovation

In the early years of crypto, altcoins were often seen as cheap copies of Bitcoin. But as technology evolved, many altcoins began addressing Bitcoin’s limitations — such as transaction speed, scalability, and smart contract support.

By 2025, the altcoin market has grown into a multi-trillion-dollar ecosystem, powering everything from decentralized finance to AI-powered economies and the Metaverse. According to the Altcoin Market Trends 2025, altcoins now represent over 55% of the total crypto market capitalization, up from 40% in 2022.

This growth is fueled by three powerful forces: technological advancement, institutional adoption, and retail accessibility.

💡 Key Altcoin Market Trends 2025

Let’s break down the major developments defining this year’s altcoin landscape.

1. The Rise of Ethereum 2.0 and Layer-2 Dominance

Ethereum’s shift to proof-of-stake in 2022 was only the beginning. By 2025, Layer-2 scaling solutions such as Arbitrum, Optimism, and Base have made Ethereum faster and cheaper.

These innovations are driving the adoption of decentralized apps (dApps), non-fungible tokens (NFTs), and DeFi services — ensuring Ethereum remains at the heart of the Altcoin Market Trends 2025.

Even newer blockchains like Solana, Avalanche, and Sui are leveraging parallel processing and cross-chain bridges to increase speed and reduce costs, further expanding the altcoin ecosystem.

2. Real-World Assets (RWA) Tokenization

One of the biggest shifts noted in Altcoin Market Trends 2025 is the tokenization of real-world assets.

Projects like Chainlink, MakerDAO, and Centrifuge are creating blockchain-based versions of real assets — such as government bonds, real estate, and commodities.

This integration bridges traditional finance (TradFi) with crypto, unlocking trillions in liquidity. It’s no longer just about digital coins — it’s about a digital economy.

3. AI-Integrated Blockchains

Artificial Intelligence is no longer separate from blockchain — it’s merging with it. AI-integrated altcoins like Fetch.AI, SingularityNET, and Ocean Protocol are creating intelligent data marketplaces and automated trading platforms.

These projects, highlighted by BTCMARKETNEWS, are reshaping how we use blockchain in industries like healthcare, logistics, and data management. The Altcoin Market Trends 2025 show that this intersection of AI and blockchain will define the next wave of technological innovation.

4. Institutional Adoption and Regulation

In 2025, institutional investors have moved beyond Bitcoin ETFs. They are now diversifying into Ethereum, Solana, and Avalanche, driven by clearer regulation and transparency.

Countries like the United States and Singapore are establishing regulatory frameworks for altcoins, ensuring safer participation from global investors. This trend gives credibility and stability to the Altcoin Market Trends 2025, proving that digital assets are maturing into recognized financial instruments.

5. The Growth of Cross-Chain Ecosystems

Interoperability is the backbone of the new crypto era. Cross-chain bridges like LayerZero and Wormhole are allowing liquidity to flow freely between blockchains.

This innovation ensures that users no longer have to choose one ecosystem — instead, they can move seamlessly between Ethereum, Solana, BNB Chain, and other networks.

It’s a defining trend in the Altcoin Market Trends 2025, fueling mass adoption and improving scalability across DeFi and NFT markets.

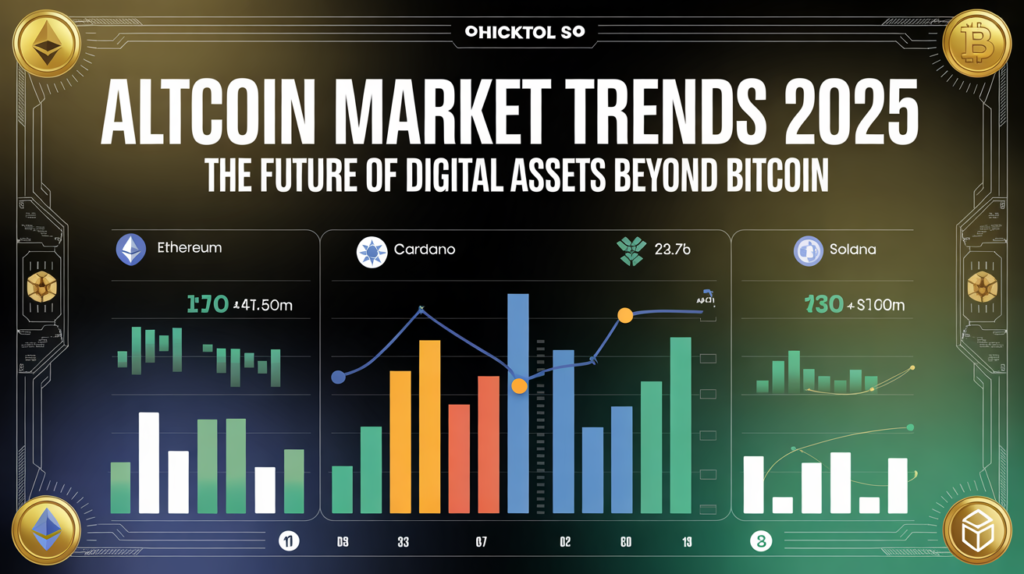

📈 Altcoin Market Leaders in 2025

Here are some of the most influential projects dominating the Altcoin Market Trends 2025:

-

Ethereum (ETH): The backbone of smart contracts and DeFi.

-

Solana (SOL): Fast, scalable, and powering Web3 innovation.

-

Avalanche (AVAX): Bridging institutional finance and decentralized apps.

-

Chainlink (LINK): The bridge between blockchain and real-world data.

-

Polygon (MATIC): Providing Layer-2 scaling for Ethereum dApps.

-

Arbitrum (ARB): Leading the Layer-2 revolution.

-

Fetch.AI (FET): Pioneering AI and autonomous blockchain systems.

Each of these projects plays a crucial role in building a more efficient, interoperable, and user-friendly crypto environment.

⚖️ Challenges Ahead for the Altcoin Market

Even with remarkable progress, BTCMARKETNEWS highlights that challenges persist within the Altcoin Market Trends 2025:

-

Regulatory uncertainty: Although improving, some governments still lack clear guidelines for altcoin projects.

-

Security risks: DeFi protocols remain vulnerable to hacks, rug pulls, and smart contract exploits.

-

Market volatility: Altcoins tend to move faster — both up and down — compared to Bitcoin.

-

User education: New investors often underestimate risks and fall for scams due to misinformation.

Addressing these challenges will be vital for long-term market stability.

🌟 The Future of Altcoins Beyond Bitcoin

The Altcoin Market Trends 2025 make one thing clear — altcoins are no longer Bitcoin’s supporting act. They are the foundation of the next generation of blockchain innovation.

As technology advances, we’ll see more AI-powered DeFi, tokenized assets, and interoperable ecosystems that transform how we store, trade, and use value globally.

The altcoin market is evolving from speculation to real-world impact, influencing industries from banking to supply chains.

As BTCMARKETNEWS puts it:

“The future of crypto isn’t just decentralized — it’s intelligent, connected, and borderless.”

🧠 FAQs About Altcoin Market Trends 2025

Q1: What are the biggest drivers of Altcoin Market Trends 2025?

The main drivers include Layer-2 scaling, AI integration, real-world asset tokenization, and institutional participation.

Q2: Are altcoins riskier than Bitcoin?

Generally, yes. Altcoins are more volatile but can also offer higher returns. Always research thoroughly and use trusted sources like BTCMARKETNEWS.

Q3: Which altcoins are performing best in 2025?

Ethereum, Solana, and Chainlink are among the leaders, with emerging stars like Arbitrum and Fetch.AI making waves.

Q4: How is regulation shaping the altcoin market?

Governments are introducing frameworks that promote investor protection while encouraging innovation. This clarity is boosting institutional investment.

Q5: What role will AI and Web3 play in the future of altcoins?

AI-driven DeFi platforms and Web3 ecosystems will enable smarter, automated, and more personalized crypto interactions.

🏁 Conclusion

The crypto market of 2025 is vibrant, competitive, and evolving faster than ever. While Bitcoin remains the flagship, altcoins are driving innovation, scalability, and utility.

The Altcoin Market Trends 2025 clearly show a future where digital assets become part of everyday life — integrated into banking, real estate, entertainment, and beyond.

As adoption spreads and technology matures, altcoins will continue to shape the next chapter of global finance.

For continuous updates, insights, and expert analysis, follow BTCMARKETNEWS — your trusted source for all things crypto, DeFi, and Web3.