Digital Ownership in 2025 — The Future of Blockchain, NFTs & Decentralized Identity

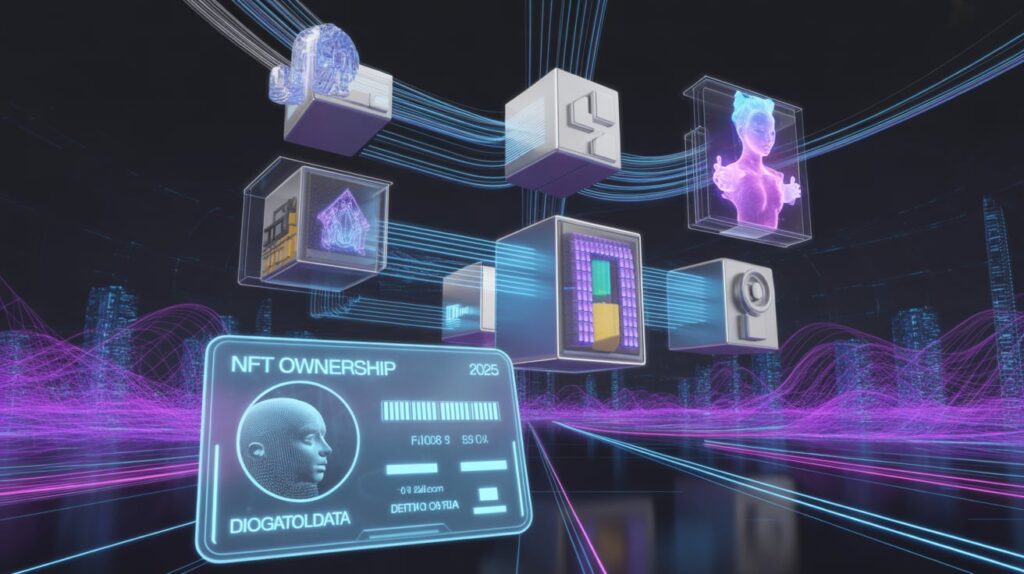

In the digital era, ownership has evolved from tangible assets to purely digital ones. From cryptocurrencies and NFTs to virtual real estate and decentralized identities, digital ownership has become the foundation of a new internet economy. In 2025, this shift defines not only how we trade, create, and collaborate online but also how we express value and identity in a decentralized world.

What is Digital Ownership?

Digital ownership refers to the verified possession and control of digital assets — whether they’re tokens, media files, domain names, or virtual land — authenticated via blockchain or decentralized systems.

Unlike traditional digital goods that can be copied or restricted by platforms, digital property rights in 2025 are managed on public ledgers, allowing provable, transferable, and secure ownership.

For instance, if you own a piece of virtual land in the metaverse or an NFT linked to an art file, that record exists on a blockchain — publicly visible, immutable, and verifiable.

Traditional vs. Blockchain Ownership

-

Traditional systems rely on centralized servers or platforms (e.g., social networks or app stores) to validate ownership.

-

Blockchain systems record rights directly on distributed ledgers, eliminating intermediaries and ensuring transparency.

This change is monumental. It transfers power from corporations to individuals — enabling creators, investors, and users to truly own their digital existence.

How Blockchain Enables True Digital Ownership

Blockchain technology acts as the foundation of trust for digital property. Every asset tokenized on a blockchain carries a unique cryptographic signature, proving authenticity and ownership.

1. Immutable Records

Once a transaction is recorded on-chain, it can’t be altered or deleted. This immutability gives ownership its strongest form of validation — one that can’t be faked, stolen, or reversed without the owner’s private key.

2. Transparency and Provenance

Blockchain offers an open ledger of every transaction. This allows verification of the full history of a digital asset, from its creator to each subsequent owner — solving long-standing problems like counterfeiting or duplicate licensing.

3. Smart Contracts

Smart contracts are self-executing programs embedded in blockchain networks. They automatically enforce ownership rights — handling royalties, transfers, and authenticity without human oversight.

For example, an NFT artwork can send 5% of every resale to its original creator — forever — because the rule is coded in the contract itself.

NFTs and Tokenized Assets

NFTs (Non-Fungible Tokens) represent unique items on the blockchain. By 2025, the NFT ecosystem has matured far beyond digital art — extending into music, gaming, ticketing, and real estate.

The Rise of NFT Utility

In 2025, NFTs are increasingly utility-driven:

-

Gaming assets like weapons, skins, or characters owned across platforms.

-

Music & film rights where creators retain royalty streams.

-

Identity NFTs representing verified credentials.

-

Metaverse land deeds or virtual property.

Fractionalized Ownership

One of the key innovations is fractional ownership — splitting expensive NFTs or tokenized assets into shares, allowing collective investment. It democratizes access to high-value digital properties just as stocks did for companies.

Smart Contracts and Proof of Ownership

Every blockchain-based asset depends on a proof of ownership mechanism, secured by cryptographic keys. The private key functions as your digital signature — losing it could mean losing access to your assets.

Smart contracts enable ownership transfer without needing notaries, lawyers, or centralized platforms. Ownership changes instantly, securely, and publicly on the ledger.

These features are leading to legal recognition of blockchain records as valid proofs of ownership in several jurisdictions across the U.S., EU, and Asia.

Decentralized Identity & Data Ownership

The idea of owning your digital identity is reshaping privacy and authentication. In Web2, your identity is fragmented across platforms. In Web3, decentralized identity (DID) systems let you control how your data is used, verified, and shared.

1. Self-Sovereign Identity (SSI)

SSI means users own and control their identity information without relying on central authorities. Credentials (like age, citizenship, or qualifications) are stored in secure wallets, shareable only with consent.

2. Data Ownership Revolution

Today’s data economy is driven by advertising giants profiting from user information. Digital ownership reclaims that power — users can decide whether to sell, share, or hide their data. Some decentralized apps (dApps) already pay users directly for opting to share anonymized information.

Web3, Metaverse, and the Next Economy

The metaverse and Web3 are interlinked visions of digital space and digital ownership. Users will not just visit the internet; they will live in it — with avatars, assets, and identities tied to blockchain wallets.

Web3 Commerce

Brands and creators sell tokenized products that users actually own — from in-game items to event access.

Payments happen through crypto wallets, ownership through NFTs, and interactions via decentralized platforms.

The Metaverse Land Rush

Virtual worlds like Decentraland and The Sandbox introduced the idea of land as a digital asset. By 2025, enterprises are establishing headquarters in these worlds — turning virtual property into a major business segment.

Metaverse real estate is projected to reach USD 60 billion by 2030, showing the scale of digital ownership’s economic impact.

Legal & Regulatory Aspects of Digital Property

Governments worldwide are adapting property laws for blockchain-based ownership.

-

United States: Several states now recognize blockchain ledgers as valid records of ownership.

-

European Union: The MiCA framework addresses asset classification, consumer protection, and identity.

-

Asia: Countries like Japan and South Korea have adopted NFT and crypto licensing schemes.

Taxation & Intellectual Property

NFT royalties, token sales, and digital transfers are taxable events in most jurisdictions. Likewise, questions about copyright, derivative use, and creator rights remain central to digital ownership debates.

Challenges Ahead

Despite progress, digital ownership faces hurdles:

-

Legal recognition differences across borders

-

Environmental concerns around proof-of-work systems

-

Security risks (wallet theft, phishing)

-

Complexity for mainstream users

Still, these are challenges of maturity — not impossibility.

Future Predictions and Market Outlook

1. Interoperable Ownership

Assets will move seamlessly between metaverses, games, and apps. A single wallet will control your entire digital life — identity, currency, and content.

2. Real-World Tokenization

Physical properties (houses, cars, art) will be tokenized on blockchains, creating a unified record of ownership both online and offline.

3. Decentralized Creator Economy

Artists, developers, and influencers will earn directly from their audiences using smart-contract royalties, bypassing intermediaries.

4. AI-Generated Ownership

With AI generating art, music, and code, blockchain will verify authorship — ensuring creators (human or AI) can prove origin and ownership.

5. Institutional & Legal Integration

Banks, insurers, and governments will integrate blockchain registries to verify ownership of assets, reducing fraud and paperwork.

Why Digital Ownership Matters for 2025 and Beyond

Digital Ownership 2025 | The Future of Blockchain, NFTs & Decentralized Identity

Digital ownership is more than technology — it’s about economic empowerment and individual freedom.

It allows creators to monetize directly, users to control their data, and communities to build value without corporate oversight. In a world where attention, identity, and creativity are currency, owning your digital life means owning your future.

As we step deeper into the age of Web3, digital ownership 2025 represents the cornerstone of an equitable, decentralized, and transparent global economy.